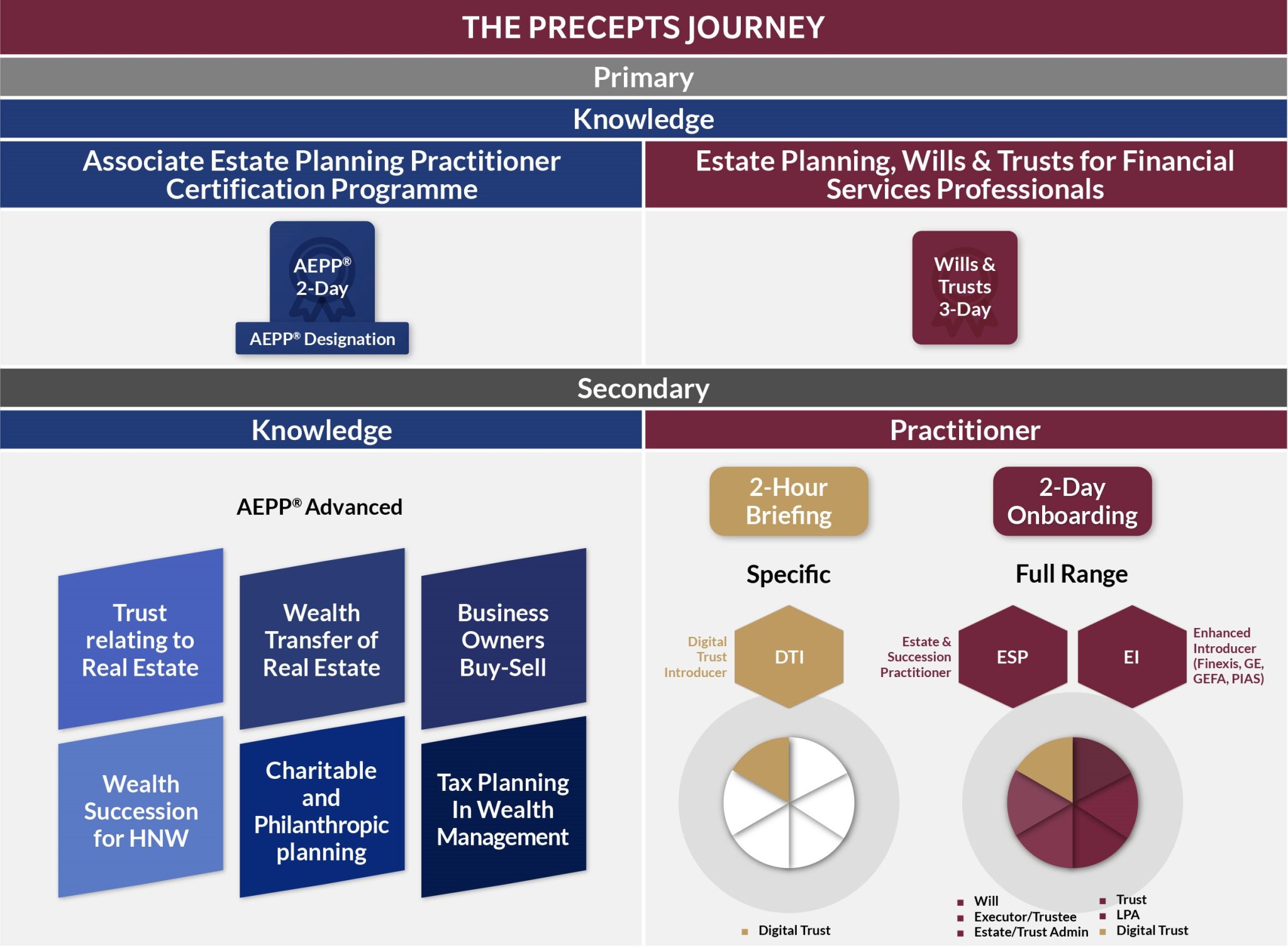

AEPP® Courses

About AEPP®

12 CPD hours

The Associate Estate Planning Practitioner (AEPP® ) designation certification programme is a 2-day marketing-based course for professional financial advisers to enable them to offer estate and succession planning advice to enhance their core services. Since 2009, this programme addresses the growing needs of the mass affluent for a comprehensive discussion on estate and succession planning in Asia. It has to date benefited more than 6,000 practitioners in Asia within the banking and financial planning industry as they are now equipped with knowledge of another topic that expands their advisory scope.

Upon completion and passing of an examination, participants will be able to add the AEPP® designation to their professional qualification title/ credentials. The accreditation of The Associate Estate Planning Practitioner (AEPP® ) is awarded by the Society of Will Writers of the United Kingdom and the Estate Planning Practitioners Limited (EPPL).

About AEPP® Advanced Modules

In Singapore, participants of the AEPP® programme can tap on the Financial Training Scheme (FTS), known as IBF-FTS funding to subsidise their training fee and also clock in their mandatory Continuing Professional Development (CPD) hours.

- Receiving high-value practical knowledge that can be applied to their current practice immediately and stay ahead of their competitors.

- Gaining access to the expertise of practitioners of estate planning who are able to relate real-life case studies and their applications.

- Having the ability to apply the practical concepts taught in this programme

Click to see other Resources:

Overviews

Objectives of AEPP® Certification Programme

- Estate Planning complements what an adviser currently is equipped with in Wealth Creation, Wealth Accumulation & Wealth Preservation.

- To gather practical knowledge about estate & succession planning, you would gather the basic knowledge and skills to assist in the Wealth Distribution part of your client’s financial plan.

- There will be case studies in the class to make the learning more applicable to the real-life scenarios when you meet your client.

Key Learning Outcomes

Upon completion of this 2-day AEPP® certification programme, professional advisers will be equipped with the essential skills to engage with their clients on succession planning. Upon attainment of the AEPP® designation, the professional advisers’ names will be reflected and searchable on the EPPL website. Participants can look forward to:

- Receiving high-value practical knowledge that can be applied to their current practice immediately and stay ahead of their competitors

- Gaining access to the expertise of practitioners of estate planning who are able to relate real-life case studies and their applications

- Having the ability to apply the practical concepts taught in this programme

Our Programme Trainers

Mr. Alan Wong

AFP®, AEPP®

W3 Consultancy Pte Ltd

Mr. Lee Chiwi

Advocate & Solicitor, ChT, TEP

CEO, PreceptsGroup International Pte Ltd

Chairman, Estate Planning Practitioners Limited

Mr. Johann Tay

AEPP®

Senior Estate and Succession Practitioner

Roadmap To Be An Estate And Succession Practitioner