Lee Chiwi

Ku Swee Yong

CEO

International Property Adviser Pte Ltd

At a seminar on 7th June 2023, Lee Chiwi, CEO of PreceptsGroup International, and Ku Swee Yong, Key Executive Officer of International Property Advisor Private Limited, spoke on the Additional Buyer’s Stamp Duty (ABSD) Measures & Impact on Property Wealth Succession.

With yet another round of ABSD changes in April 2023 it is crucial for property owners, investors, and estate planners to understand the implications of these changes. Foreigners looking to purchase residential property in Singapore now face higher stamp duties, which have doubled to 60%. Singapore citizens purchasing their first property will experience no change in stamp duties. However, the rates have significantly increased for those buying their second and subsequent properties, with a rate of 20% for the second property and 30% for the third and subsequent properties. Permanent residents also face higher rates of 30% and 35% for their second and third property purchases, respectively. The ABSD measures also affect property purchases made through companies or trusts. The stamp duty rate for such acquisitions has increased from 35% to 65%, closing potential loopholes.

The speakers discussed the impact on the market trends, the purchase, holding and succession of Singapore residential properties covering various topics such as:

- How existing owners should deal with the succession of their valuable properties.

- The need to avoid inherited properties being a stumble for their beneficiaries.

- For clients owning multi-million-dollar properties, the planning strategies bearing in mind a much higher property tax regime today.

- For foreigners, such as the Malaysian, Indonesian and Chinese National client with assets in Singapore, the opportunities to set up trusts for succession planning.

- Apart from ABSD, the other tax implications, such as seller’s stamp duty and property taxes.

Property taxes, calculated based on the annual value, have seen a significant increase, affecting property owners’ overall costs and potential returns. This will be a factor whether the property concerned should be liquidated on death rather than being transferred to the next generation.

The relationship between property prices, the rental market, and the ABSD measures should be assessed. It is possible that the higher property taxes resulting from the measures could prompt some property owners to rent out their vacant units to offset the increased costs. As a result, the rental market could experience an uptick in supply, leading to changes in rental prices.

The ABSD measures may impact first-time buyers and those seeking to upgrade their properties. While property agents may encourage urgency in purchasing due to the perceived market conditions, a comprehensive analysis of costs and potential returns should be conducted. Affordability, interest rates, and future property appreciation must be considered when making decisions.

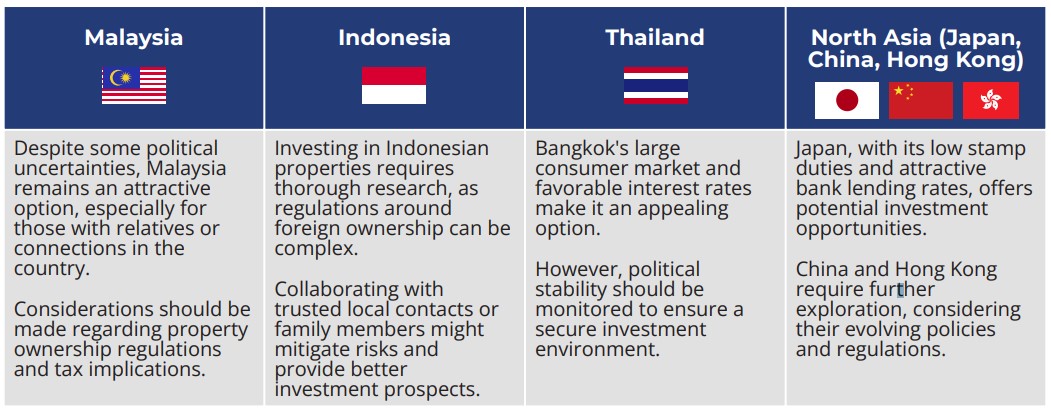

With the ABSD hikes, investors might consider diversifying their real estate portfolios in other countries within the region. Here were some insights on potential investment opportunities:

This article was first published in our newsletter, The Custodian Issue 26. Click here to access our latest newsletter.