- Wealth management has evolved significantly over the years, with affluent families seeking sophisticated solutions to preserve and grow their assets across generations. In Singapore,

Blog

- Be aware of unintended outcomes that may result from the disposition of assets that a testator co-owns with other people upon his death, writes

- Warren Yap, who is a Senior Estate & Succession Practitioner with PreceptsGroup shares with us that becoming an Estate & Succession Practitioner added a

- While both a Will and a business succession plan deal with the transfer of assets and responsibilities, they serve different purposes and cover different

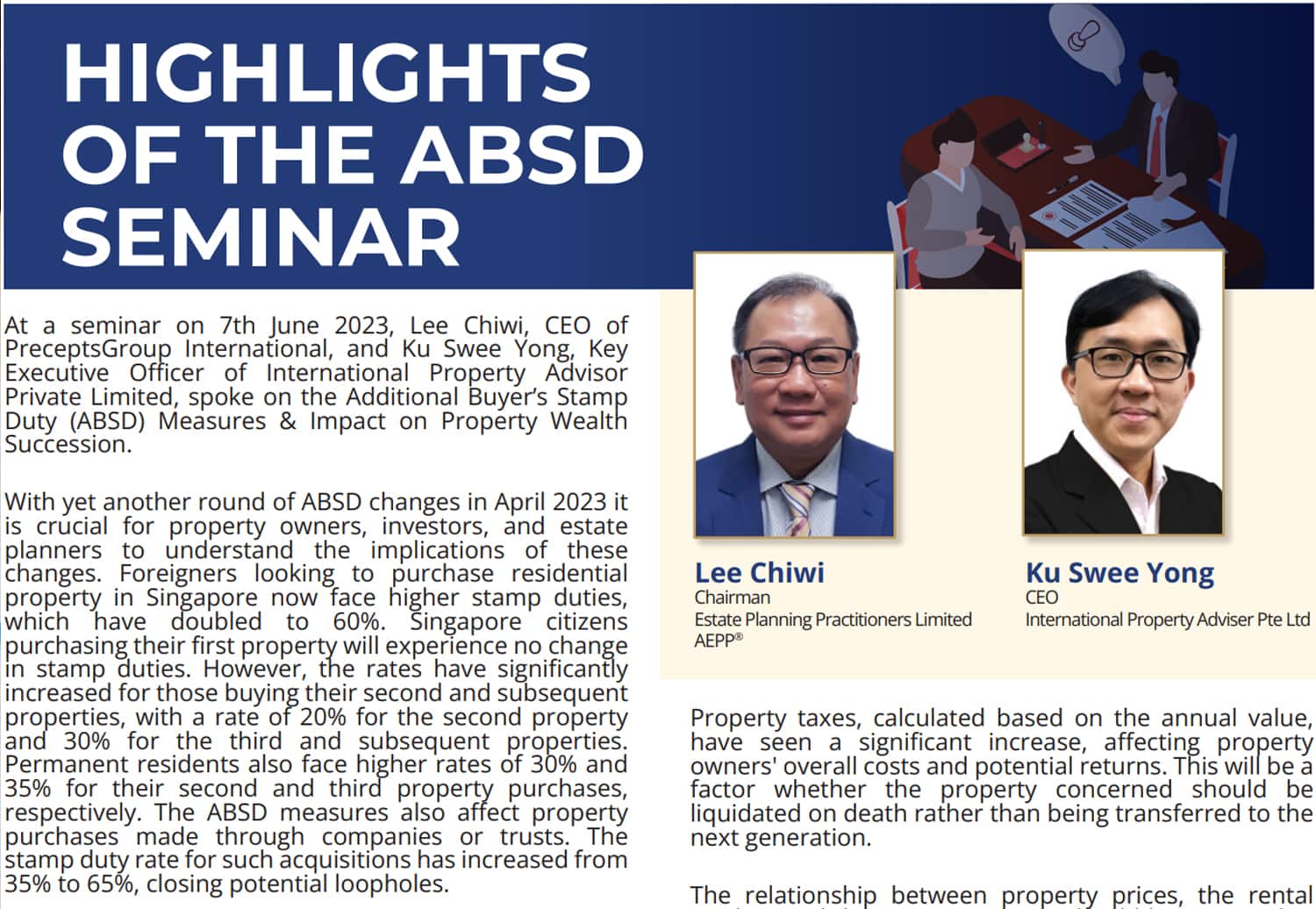

- At a seminar on 7th June 2023, Lee Chiwi, CEO of PreceptsGroup International, and Ku Swee Yong, Key Executive Officer of International Property Advisor

- One way to ensure that your loved ones receive the benefits that you have earmarked for them after your death, is to establish a

- In the Straits Times on 27 Mar 2020, one of the articles of a columnist’s headline read “No more denying the importance of having

- In part 2 of this Case Study, we looked at how executors go about handling digital assets of financial value. We noted that it

- Lisa Gay (Business Executive, Marketing Department, Precepts) caught up with Ms Lim Kim Hong and Hwee Heng (Head of Marketing Department, Precepts) to understand