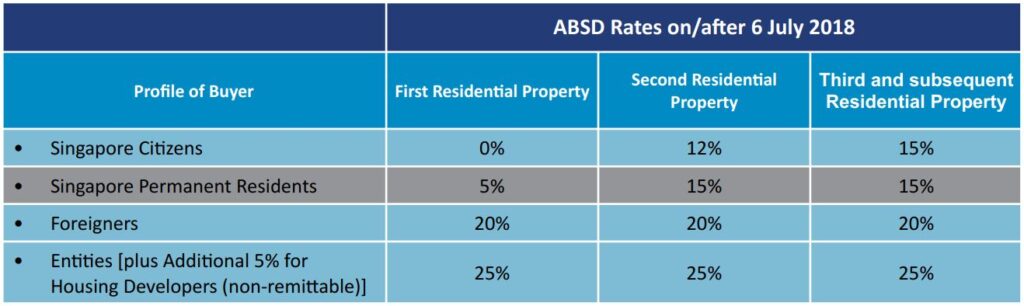

ABSD is Additional Buyer’s Stamp Duty. This is introduced as part of property cooling measures to cool the hot property market since 2011. This only applies to residential properties.

There are other measures such as Seller’s Stamp Duty (SSD), changes to Loan to Value, etc. In order to promote prudent lending and borrowing, there is the TDSR (Total Debt Servicing Ratio) Framework introduced in 2013.

Property owners and investors are mindful on the ABSD when they are planning on their next property purchase.

In this article, we are focusing on the impact of ABSD upon the death of property owners.

For example, do the beneficiaries need to pay ABSD to inherit properties if they already owned property on their own?

If it is direct inheritance, whether with or without a Will, no Buyer’s Stamp Duty (BSD) and ABSD will be applicable.

As an illustration, Mr Tan is a widower who had 3 children. He died without a Will and his property will be inherited equally by his 3 children. All his children already have their own property. In this case, the children can inherit the property without any BSD and ABSD.

They would now have 2 properties count under them respectively. This will add on to their ABSD liability if they want to buy additional property.

However, if the 2 children want to sell their share to their eldest brother, he will have to pay ABSD to buy over their share since he already had 1 property.

This may not be an ideal situation as additional tax need to be paid. Mr. Tan could have saved his children the hassle and cost by making property succession planning. Mr. Tan can determine which of his children will need the property most and bequest to him. He can then bequest cash to the other children. He can create the estate through insurance policy. His children will be grateful for such legacy.

There are also other considerations such as Seller’s Stamp Duty (SSD) and TDSR.

Singapore has high property ownerships and property owners need to plan on their property succession as their legacy planning.

This article was first published in our newsletter, The Custodian Issue 16 on February, 2021. Click here to access our latest newsletter.