Edwan Khow

CFP, CPA

Principal, Key Points Consulting Group

Edwan Khow CFP, CPA, the principal of the Indonesian tax and accounting advisory firm Key Points Consulting Group, provides some answers to key questions relating to the forex tax in Indonesia.

The forex tax in Indonesia applies to profits from foreign exchange trading. In this context, the profit is the difference between the purchase price and selling price of foreign currencies derived from forex transactions. The Indonesian government usually imposes this tax to obtain government revenue from the forex sector and regulate foreign exchange trading activities.

The application of this forex tax has been regulated in Article 4 paragraph 1 letter I of the Income Tax Law Number 36 of 2008. Income tax is imposed on every income in any name and in any form, one of which is the profit on foreign exchange differences based on the principle of source and principle of domicile:

The forex tax in Indonesia applies to profits from foreign exchange trading. In this context, the profit is the difference between the purchase price and selling price of foreign currencies derived from forex transactions. The Indonesian government usually imposes this tax to obtain government revenue from the forex sector and regulate foreign exchange trading activities.

- The source principle applies to every tax subject – foreign or domestic – who earns income sourced from Indonesia. They will be subjected to income tax by the Indonesian government.

- The domicile principle applies to every tax subject who meets the requirements of domicile in Indonesia. Income earned from income sources in Indonesia and outside Indonesia is subject to income tax by the Indonesian government and by the provisions of tax legislation in Indonesia.

Who will be the object of forex tax?

What about assets located abroad?

Foreign exchange is a global market for currency trading. It is decentralised, that is, not fixed to any physical location. According to the Income Tax Law, all income received in any form by Indonesian citizens residing within the country or abroad is subject to tax on the value of the income received.

Based on the law, traders must also pay taxes on the profits they earn from forex trading. Forex traders that trade through brokers abroad must still pay taxes in Indonesia by applicable regulations. The tax to be paid is the final income tax (PPh) of 20%. However, if the trader also has other income earned in Indonesia, the tax to be paid will differ according to the applicable tax rate.

What are the forex tax tariffs?

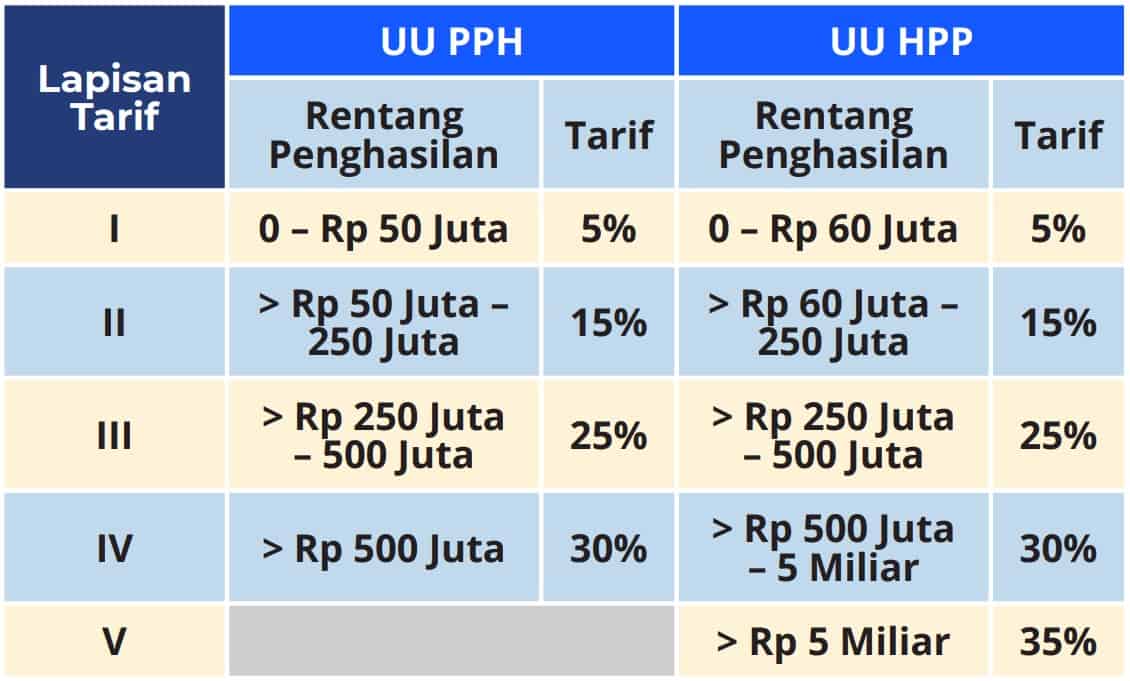

Tax rates for domestic individual taxpayers due to differences in foreign exchange rates or forex trading follow the provisions in the General Income Tax rate, namely in Article 17 of the Income Tax Law Number 36 of 2008 (UU PPH) which was amended by the Job Creation Law and the Law on Harmonization of Tax Regulations (UU HPP). The two laws have different layers of rates (lapisan tarif) and income ranges (rentang penghasilan) in the Indonesian rupiah as shown in the table.

This article was first published in our newsletter, The Custodian Issue 26. Click here to access our latest newsletter.