A person’s debts do not cease to exist with death. Although family members are generally not personally responsible for the debts, the rules of bankruptcy apply to insolvent estates and creditors must be paid through the funds in the estate. An insolvent estate happens when the debts of the deceased are greater than the total value of assets.

There are various types of debts and it includes outstanding credit card debts, loans and taxes. Debts account for a significant component in the estate administration. Precepts Trustee Ltd is a licensed trust company that administers estates. With over a decade of experience, we have handled a variety of estates with varying complexities and involving litigation.

Let’s take a look at a real-life example from one case handled by Precepts Trustee Ltd.

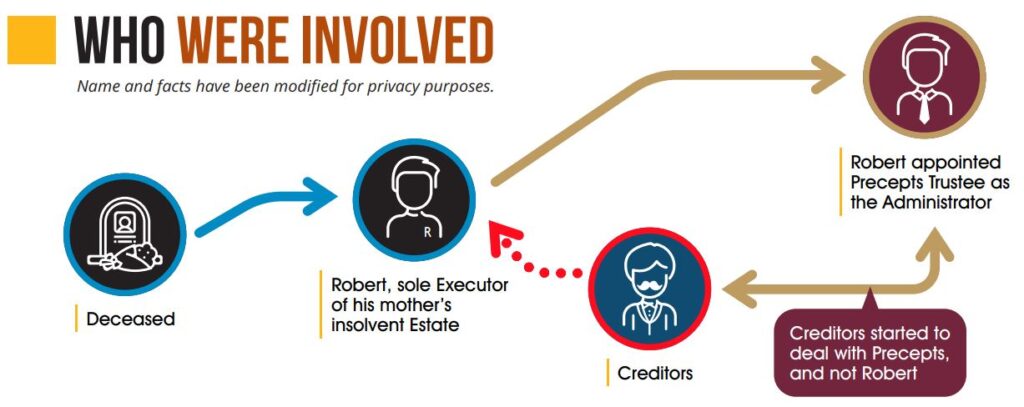

This case unfolded with Robert’s call to Precepts looking for help. In the call, Robert* informed us that he had been appointed as the sole executor and trustee of his late mother’s Will. According to Robert, his mother did not appoint any other executor, since Robert was the sole beneficiary. However, he wanted to renounce his right to apply for the Grant of Probate. He wanted Precepts to take over his role in administering his late mother’s estate as he was facing a lot of stress and anxiety in the estate administration.

As the Will was not drafted by Precepts, we held a meeting with Robert to better understand the situation. He disclosed that his businesswoman mother had encountered some financial difficulties just before her passing. As a result, his mother had left huge liabilities behind. After studying the case, Precepts tabulated that her estate’s liabilities were projected to be greater than the remaining assets of the estate.

Ever since the creditors discovered he was the named Executor of the Estate, they started going after Robert to demand for re-payment of his mother’s debts. He received numerous calls from various banks’ collection departments almost every single day. He was also informed by the banks that late payment for his mother’s credit card debts and the legal fees would continue to accrue until full settlement!

He also realized that he would unlikely benefit from the Will as his mother’s estate was insolvent. He had no peace of mind. He was very concerned that the property which was owned in his name (he purchased with his own money together with his wife), could be taken away by the creditors. He was so pressured that he started to believe he had to sell his own house to settle the debts.

After Precepts was appointed to act as the administrator, the creditors started to deal with Precepts, and not Robert. The phone calls to Robert ended over time. It had been a long process for Precepts to deal with the banks and to meticulously verify each of the creditors’ claims. It was something Robert had not been able to do so. The estate also received claims from the Inland Revenue Authority of Singapore (IRAS). After Robert’s mother’s house was sold, the net sale proceeds were used to first settle the IRAS claim before the balance debts and liabilities were paid proportionally to the respective claims admitted by Precepts.

Robert was also relieved to find out that he could claim the money which he had advanced for his mother’s funeral expenses (with supporting documents), as this claim had priority before the rest of the creditors.

After Robert relinquished his right and appointed Precepts as the administrator of his mother’s estate, he and his wife were able to resume their lives normally again.

This article was first published in our newsletter, The Custodian Issue 16 on February, 2021. Click here to access our latest newsletter.