After introducing the reader to the Digital Facilitator in part 1 of this Case Study, we next dissect digital assets into non-financial assets and financial assets, and demonstrate how they are currently handled in the estate planning space. This separation is crucial for estate planning.

With non-financial digital assets, the Digital Facilitator is typically empowered to handle digital assets as he has been instructed by the testator. Naming the Digital Facilitator in advance makes it clear to family members of the deceased person about who is to handle such digital assets. This helps to avoid any disputes that may surface.

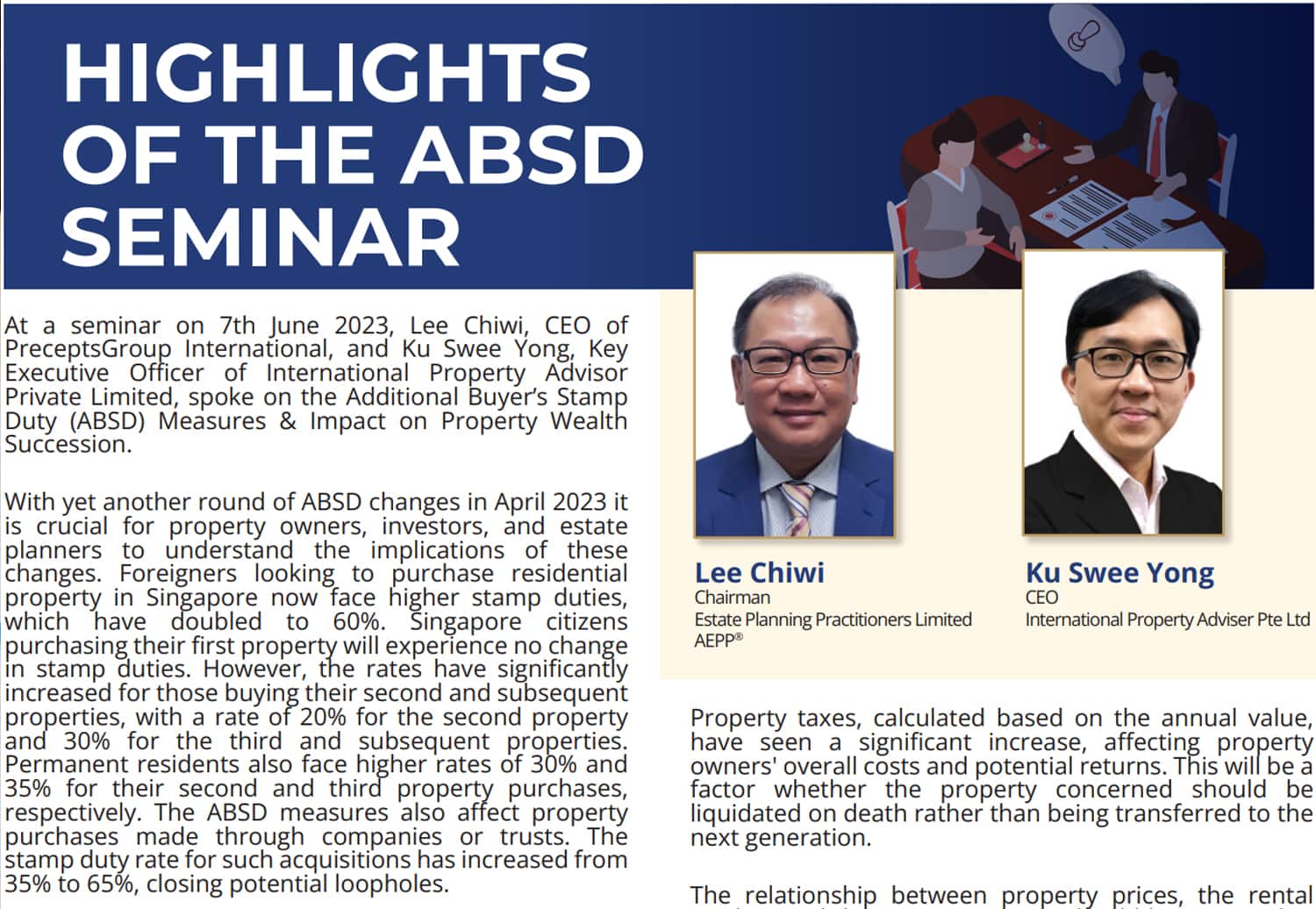

For example, the Digital Facilitator can close a testator’s personal email accounts, digital music, digital photographs, digital videos, software licenses, social network accounts, file sharing accounts, and other online accounts. Or he may have received instructions to transfer out some digital assets to close family members or friends of the person who passed away. “The executor and trustee will therefore have no role to deal with such aspects and will leave them entirely up to the Digital Facilitator,” says PreceptsGroup International Chief Executive Officer Lee Chiwi.

For example, the Digital Facilitator can close a testator’s personal email accounts, digital music, digital photographs, digital videos, software licenses, social network accounts, file sharing accounts, and other online accounts. Or he may have received instructions to transfer out some digital assets to close family members or friends of the person who passed away. “The executor and trustee will therefore have no role to deal with such aspects and will leave them entirely up to the Digital Facilitator,” says PreceptsGroup International Chief Executive Officer Lee Chiwi.

It should be noted that the person who makes the Will can also express his wishes in his actual Will about how he wants his non-financial digital assets to be distributed, or who receives access to such digital assets. If the testator has not done so already, the executor will make this information known to the Digital Facilitator.

Financial accountability for executors

Digital assets of financial value have to be treated with higher legal considerations. This is because the executor has a legal responsibility to account for the assets just as is done for other property of the estate. Such digital assets of financial value could include bitcoins and other cryptocurrencies. Considering the success of some cryptocurrencies in recent years, there are likely to be disputes if the distribution of such assets is not clearly stated in a Will.

Now, in the event of death, the executor’s job is to call in and collect all the property of the deceased person. To do that, the executor also has to do what he can to ascertain all property within the estate. Due to the dynamic nature of digital assets of financial value, it may be more difficult for the executor to do this as it is not in his area of expertise. If all digital assets of financial value cannot be accounted for, this leaves things open to potential liability issues from beneficiaries.

PreceptsGroup’s position on this scenario is that an indemnity clause be placed in the Will to absolve the executor’s liability for any failure to herd in and ringfence all relevant digital assets. As such, “there should be provisions in the Will where the executor has the full and unfettered power to access use, control and manage those digital assets as he deems fit,” says Mr Lee.

Another safeguard for the executor would be to appoint the Digital Facilitator in the Will to also handle digital assets of financial value. There is a difference between the need for this role in relation to financial and non-financial digital assets.

For digital assets of non-financial value, there is no further accountability by the Digital Facilitator to the executor. However, in the case of digital assets with financial value, the Digital Facilitator will have responsibilities towards the executor. “This envisages that the Digital Facilitator had at a prior time been given possession of confidential information disclosed to him separately by the testator,” notes Mr Lee.

Thus, the Digital Facilitator has a duty at the relevant time to provide such information accurately to the executor to account for and administer the succession of these digital assets to the beneficiaries according to the Will. But injecting the Digital Facilitator to the picture, the executor is in a much better position to distribute digital assets of financial to beneficiaries without disputes.

In the final part of our Case Study, we briefly look at some of the difficulties that can arise if the testator owns cryptocurrency assets.